US multinational computer technology company Oracle’s logo is pictured at the Mobile World Congress in Barcelona, Spain, on Feb. 27, 2024. Pau Barrena/AFP via Getty ImagesOracle Corporation reported strong second-quarter fiscal 2026 earnings after the market closed on Dec. 10, driven by heavy demand for AI-related services. Yet the company’s stock tumbled as investors increasingly weighed the risks of its rapid, debt-financed expansion to meet AI-driven capacity needs.The surge in spending on AI infrastructure has created a broader dilemma for markets: weighing the promise of high future payoffs against the risk that these investments may fail to deliver them, especially for firms that rely heavily on borrowing.

-11.9

C

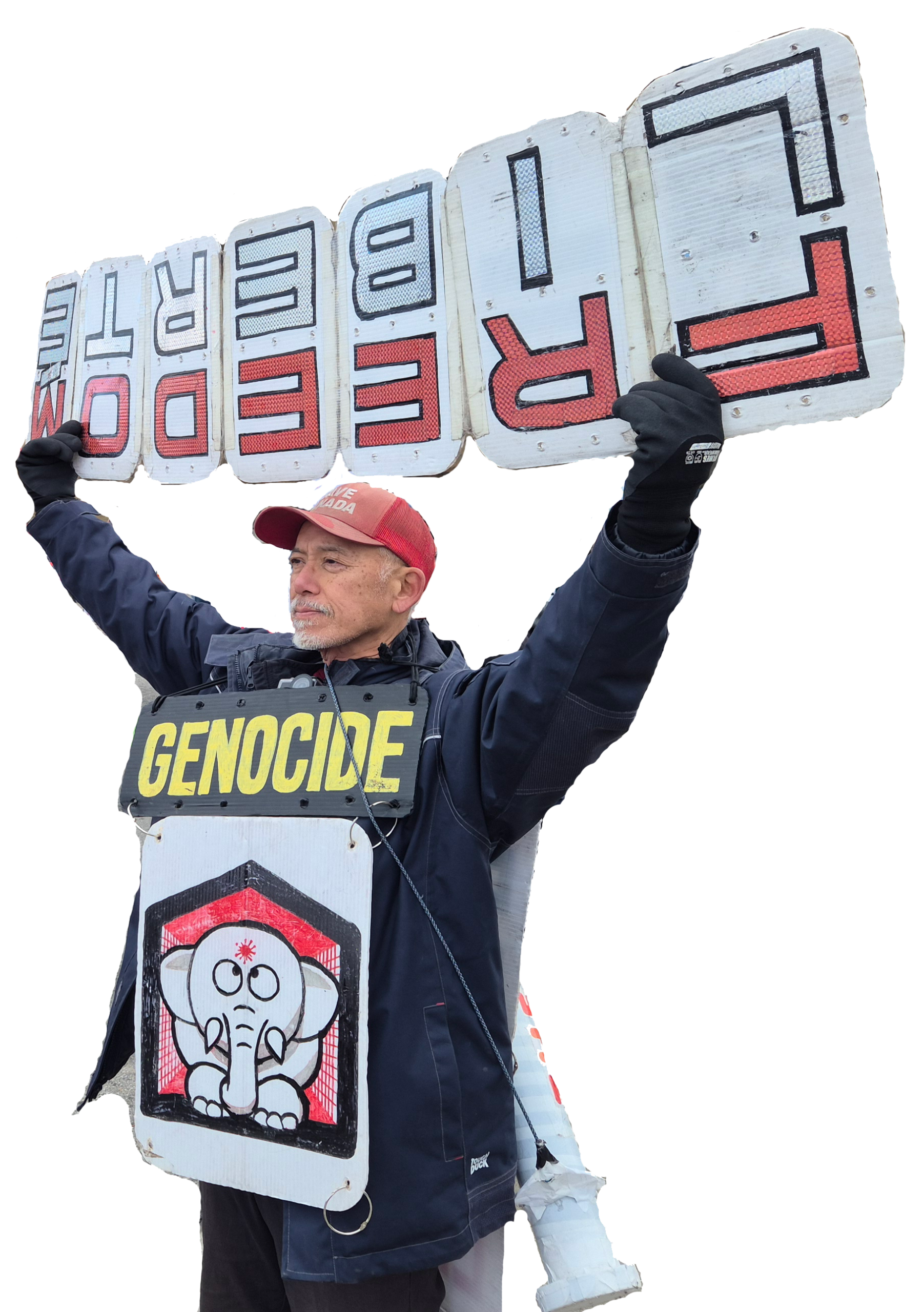

Ottawa

Monday, January 26, 2026