Stock market numbers are displayed at the New York Stock Exchange during morning trading on Sept. 17, 2025. Michael M. Santiago/Getty ImagesAs we head into the final quarter of 2025, many investors ask the same question: Is it better to rebalance now or wait? The short answer is that it’s probably a good idea, especially if your financial situation or risk tolerance has changed. But the longer, more nuanced answer depends on the markets, the economy, and your specific portfolio.In this post, we will look at the current economic situation to help you answer this question. In addition, we’ll discuss why and when rebalancing makes sense and provide a practical, tactical approach to rebalancing your investments in 2026. The Current Market Backdrop: A Snapshot of What MattersFor investors to make informed decisions, it’s vital to understand the macroeconomic environment. Currently, these key factors are influencing the market: A New Era of Monetary Policy With the Fed’s PivotAs part of its easing cycle, the Federal Reserve has begun to loosen monetary policy. In mid-September, the Fed lowered its federal funds rate to 4.00–4.25 percent, signaling that more cuts could be coming. Generally, lower interest rates boost corporate profits and make borrowing cheaper, which tends to increase risk assets, such as stocks.

-7

C

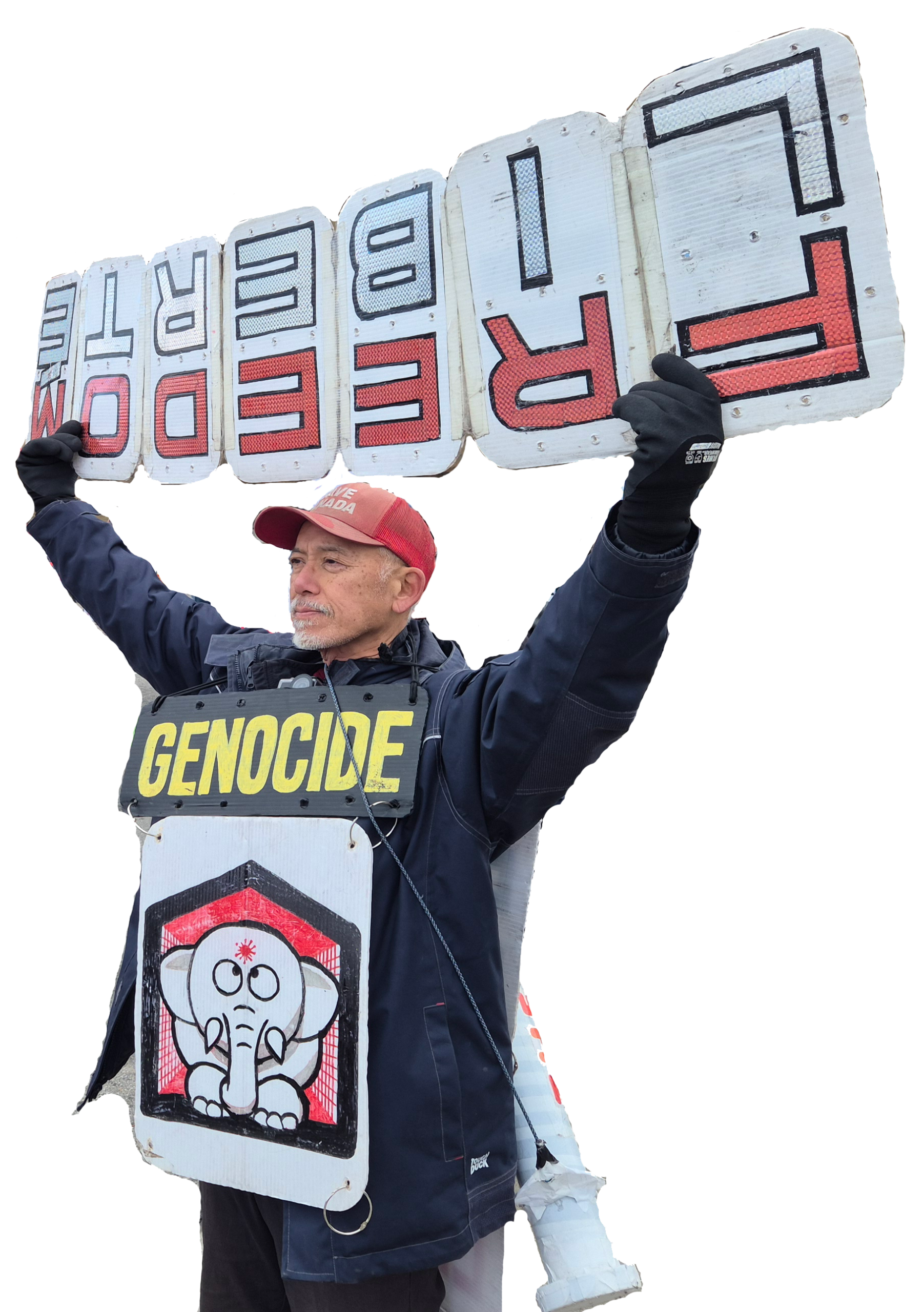

Ottawa

Friday, March 13, 2026