OTTAWA—Canada’s annual inflation in March surprisingly slowed to 2.3 percent, three notches below the prior month, largely helped by lower gasoline and travel tour prices, data showed on Tuesday.

The core measures of inflation, which are closely tracked by the Bank of Canada, however, stayed elevated, Statistics Canada said.

On a month-on-month basis, inflation rose by 0.3 percent, Statscan said.

Analysts polled by Reuters had expected the year-on-year inflation rate to remain at 2.6 percent, and on a monthly basis to rise by 0.6 percent.

The rate of increase of consumer prices in Canada has shown signs of acceleration after seven months of staying at a level of 2 percent or below.

A sales tax break from mid-December to mid-February helped mask the actual price increases. This was evident in the price increase of food and alcoholic beverages, which reversed their previous contraction and jumped in March.

Food prices jumped by 3.2 percent and alcoholic beverages increased by 2.4 percent on an annual basis.

But this increase was largely offset by a deceleration of 1.6 percent in the price of gasoline. Without gasoline, the consumer price index rose by 2.5 percent in March, Statscan said.

“The decline was largely a result of lower crude oil prices amid concerns of slowing global oil demand and slowing economic growth related to the threat of tariffs,” the statistics agency said.

Year over year, prices for travel tours declined 4.7 percent in March and air transportation prices fell 12.0 percent. The drop in air travel coincided with decreased Canadian air travel to the United States, Statscan said.

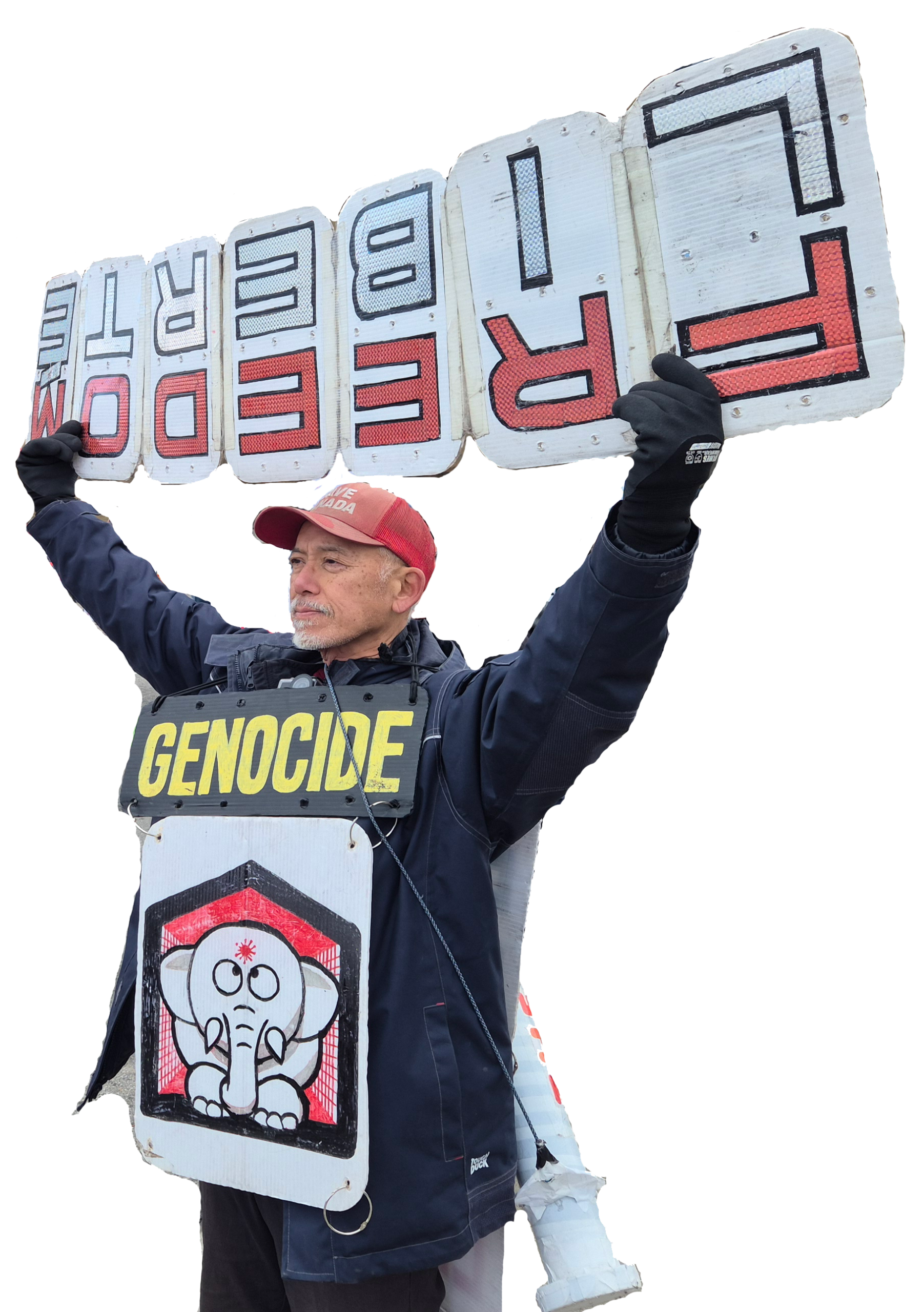

U.S. President Donald Trump’s tariffs on a variety of Canadian imports and Canada’s retaliatory measures are expected to increase prices but also suppress economic growth, putting the central bank in a bind on whether to cut or increase rates.

The BoC will announce its monetary policy decision on Wednesday. Currency markets forecast the odds of a pause after seven consecutive rate cuts by the bank at around 60 percent.

The Canadian dollar was trading down 0.28 percent to 1.3911 to the U.S. dollar, or 71.89 U.S. cents. Yields on the two-year government bonds dropped 4.2 basis points to 2.537 percent.

One of the core measures—CPI-median, or the centermost component of the CPI basket when arranged in an order of increasing prices—was at 2.9 percent in March, same as the prior month.

The other core measure CPI-trim, which excludes the most extreme price changes, slowed a tad to 2.8 percent, Statscan said.